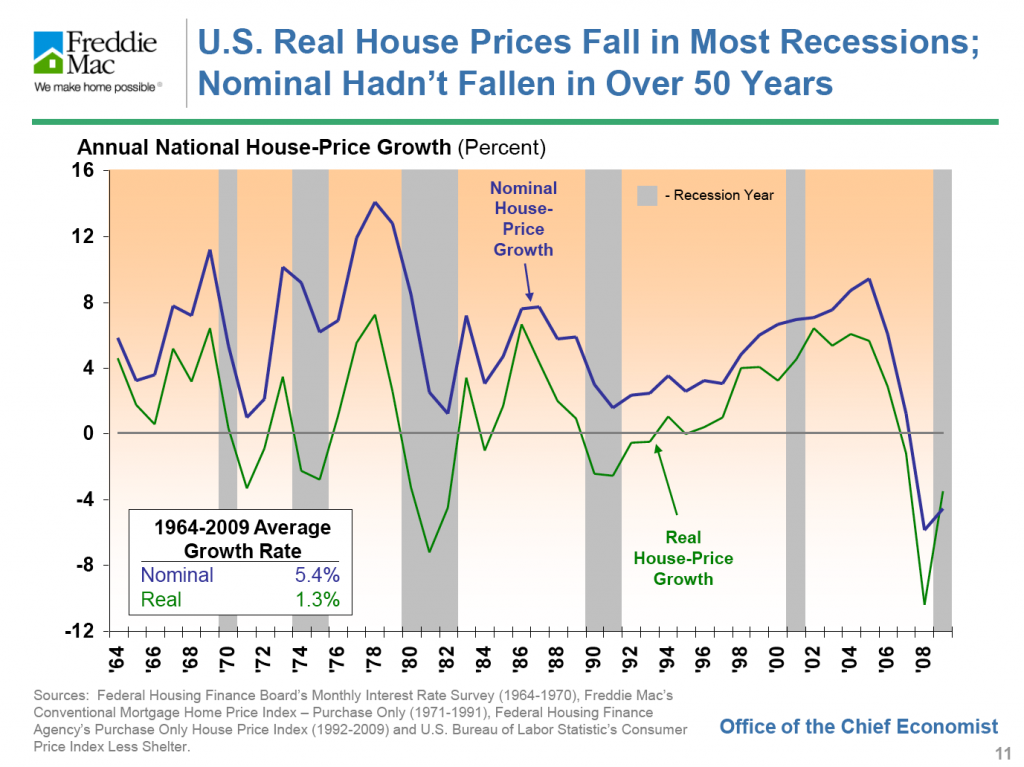

Among the scions of the real estate industry presenting at the Fisher Conference (see my previous post) was none other than Frank Nothaft, Chief Economist and Vice President of Freddie Mac. He had a doozy of a slide set. Here’s one my favorites. More to follow.

The chart shows that nominal (ie. not inflation-adjusted) prices hadn’t shown an actual decline in over 50 years prior to 2006/7. Real (inflation-adjusted) prices have fallen in previous recessions, though with the exception of 1980-82, those declines were pretty small. This time round, though, we’re down big-time.

An inflation-adjusted annual average price growth of 1.3% sure doesn’t sound like much to me. And that number’s not going up a lot even if you discount the suislide of the last three years. Proof that a home isn’t a “good investment?” I’ve never suggested that it is.

Doesn’t look a whole lot better even after you factor in leverage. If you’ve put 20% down, the rate of return on your equity increases five-fold. Now we’re up to a whole 6.5% gross return. But that’s before all the expenses of ownership not to mention the endless lists of things “to do.”

Of course, the real reason to buy a home is because it’s about “shelter” in the broadest sense of the word. It’s as basic as finding a comfortable cave for yourself and your loved ones and painting beautiful drawings on the walls.

Then again who buys and sells at the average?

Misha,

Thanks for the article. I think it’s clear from recent history that buying a home has not been a good economic investment. Banking fraud, high prices, taxes, insurance, repairs, landscaping and other costs of upkeep make this a very expensive proposition. However, we have the benefit of hindsight. I agree that people also buy homes for shelter. The question is; at what cost? And I’m not talking about economics. Prices in the Bay Area have been so prohibitive for the last 10 years, that buying a house for most of us, (I’m a renter), is a direct threat to one’s quality of life. Unless you were one of the lucky ones to buy low and sell high, the income to home price ratio requires the extreme investment of one’s “life force”; time with friends, family, school, personal interests, autonomy, mastery and purpose. A home is not a home, (or shelter), if your never there to experience it. From “waiting to win the lotto before I buy”. Cheers. J