In an article entitled Great Time to Buy (Famous Last Words), last Sunday’s New York Times took a swipe at perennially optimistic real estate agents who have never seen a time that wasn’t a good time to buy a house. Fair enough. Self-interest and magical thinking are not limited to the real estate profession.

For the record, I’ve never suggested to anyone that buying a home is a good “investment.” You can do much better in the stock market and probably even in bonds.

However, I am beginning to think that if you’re going to shackle yourself to a home, now may not be a bad time to buy. And I think the NY Times article supports my position.

Why do I think so? Most of the articles I’ve been reading suggest that the worst is over in terms of price declines, this article included. That doesn’t mean that prices couldn’t drop another 5 to 10%. But it’s a fool’s errand to try to predict the bottom (or top) of any market.

At the same time, the consensus seems to be that interest rates have nowhere to go but up, given the huge stimulus that the government’s been giving to prop up the economy. One can argue whether and when the government should choke off the spigot of easy credit, but when it does, rates are going to have to go up.

Here’s the takeaway from the NY Times article:

“Instead of betting on home prices, you make a bet on whether money will become cheaper or more expensive, allowing you to buy more or less house.”

Now it’s true that increasing interest rates ultimately lead to declining prices as tighter credit drives down demand. That’s the theory anyway. But after the huge declines we’ve already seen, it’s anybody’s guess as to when, where, or how that will happen. As the article says, “don’t go there. Maintain your focus.”

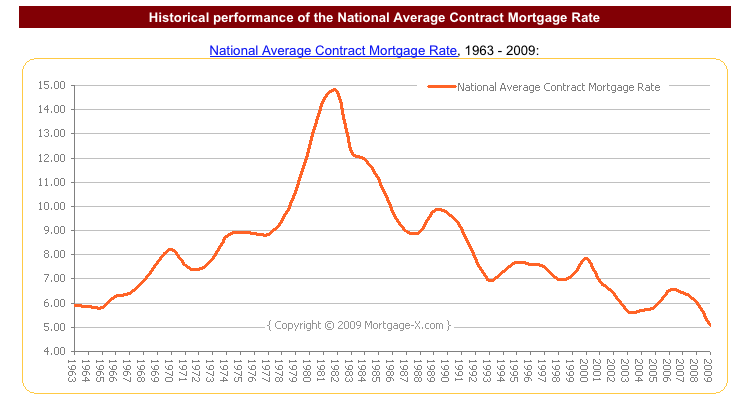

Here’s a graph from mortgage-X.com on historical blended (ie. fixed, arms, etc.) mortgage rates. Should make people who can qualify for a mortgage in this still-crazy market feel pretty good, no?

Pretty compelling graph. Should be overlayed with how much money the banks have been lending to individual home buyers… but probably not a bad time indeed to buy and fix the rate.

Pingback: Alphabet Soup Revisited: What Shape Will the Recovery Take? | Real Data SF