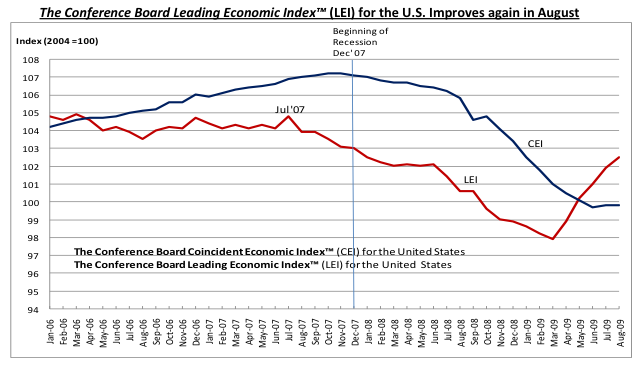

Does anyone really know what’s going on? Despite the gloom and doom of my recent posts (Waiting for the Other Sheep to Drop, Alphabet Soup: What Shape will the Recovery Take?), the latest publication of the Conference Board’s Leading Economic Index (LEI) on Tuesday trumpets: “Fifth Consecutive Increase!” The LEI is supposed to predict economic activity approximately 6 months into the future, so you’d think that a five-month run would mean it’s time to celebrate, especially given what looks like the impressive bounce shown in this graph.

(The Coincident Economic Index — blue line — shows what’s happening to the economy currently, and — no surprise — it shows we’ve bottomed out.)

To be sure, The Conference Board hedges its bets and says that while a recovery is near, “the intensity and pattern of that recovery is more uncertain.” You can find the full report here.

Meanwhile, today’s WSJ headline reads“Rebound in Home Sales Hits a Bump” , with national sales declining last month after four straight months of increases. (Thank you, X-Man, for the heads-up on this article.)

What does all this mean? I think it means two things. 1. The worst is over. 2. You might just as well go consult your magic 8-ball (“signs point to yes,” “ask again later”…) as consult the experts on what the recovery will look like.