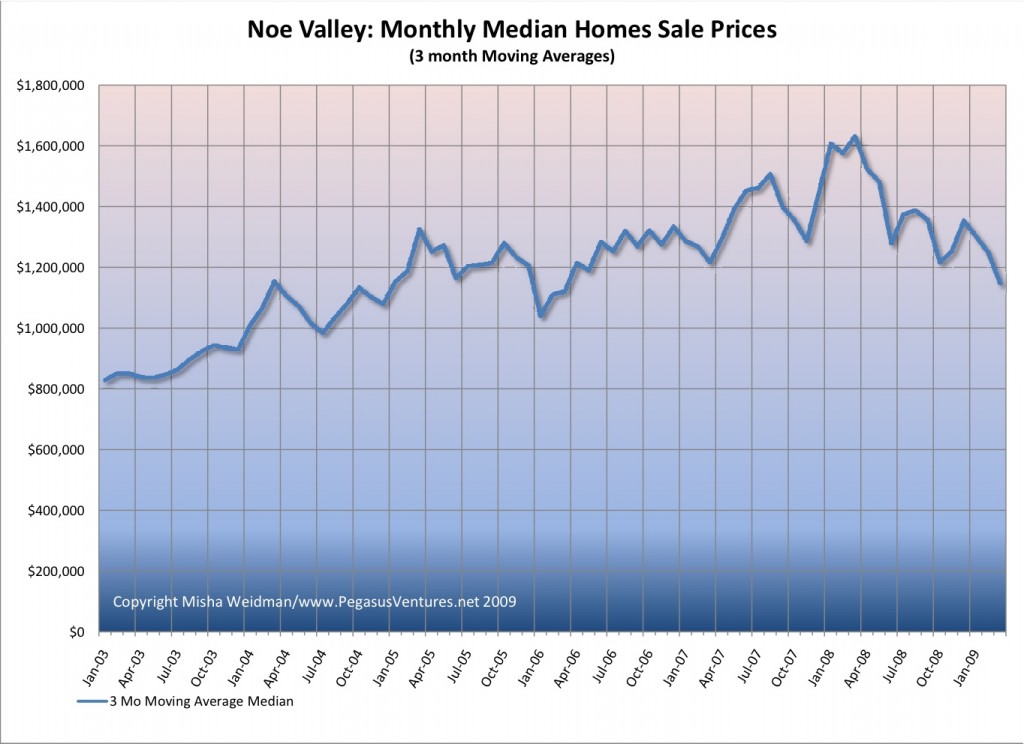

I’ve been having an interesting discussion with a regular reader of theFrontsteps, where I first posted my chart on Noe Valley Percentage Change from All-Time High. He disputes the fact that Noe Valley has fallen by 30% from its all-time high (reached in March of 2008) because he claims — I think — that March was aberrational. I’ve looked again at the data for that month and I disagree. What’s more I think that if you look simply at median prices (moving averages), they show a pretty extended upward trend from the beginning of 2006 through March 2008, with the exception of a dip during the Fall of 2007. Here’s the chart (click to enlarge). Enough said. I’m moving on to another subdistrict.

-

-

Recent Posts

- With Facebook Not Looking So Good, Is the Bloom Off the Rose in San Francisco’s Residential Home Market

- Social Media Boom Fuels San Francisco’s Rental and Home Sales Market

- San Francisco Housing and Rental Markets: Choose a Rock or a Hard Place

- Listed to Luxe in Under 30 Days

- Giving Credit Where It’s Due

-

Credit crunch trends New York Times San Francisco 729 elizabeth street single family homes Data Condominiums interest rates Bernanke Blogging Buyers Sonders TICs luxury homes condos Nouriel Roubini Economy Market SF real estate rent vs buy tax credit DOM Noe Valley District 5 fisher school 2010 UC Berkeley Market news case-shiller single family median price Forecasts Mortgages 2009 Charts condominium Pacific Heights Marketing Rants ken rosen Tenancy In Common construction home premium Front steps

Categories