Saturday’s NY Times proclaims “A Gloomy Outlook for Home Sales’ Big Season.” The headliner, by the way, was “Job Losses Hint at Vast Remaking of U.S. Economy.” Is it really any wonder we have difficulty sleeping a’ nights?

Here are some of the cheery highlights:

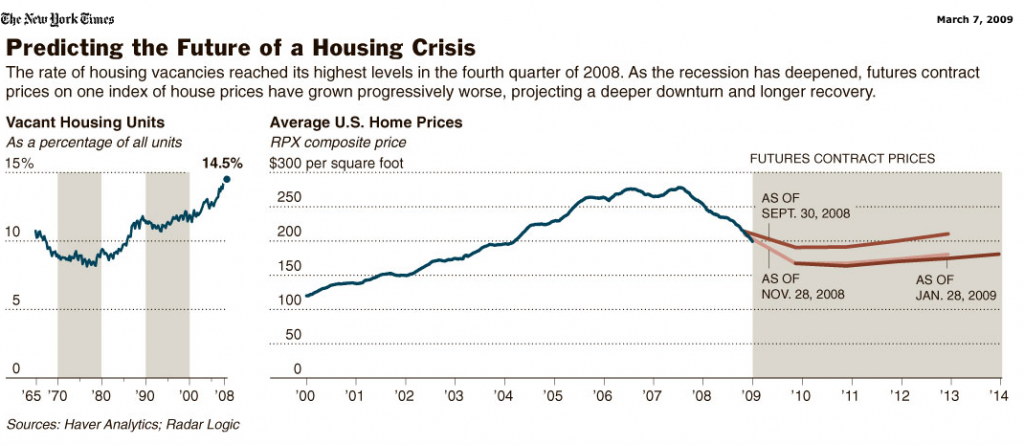

- One out of every seven apartments and houses in the US are vacant, a level not seen since the 1960’s. That’s about 19 million units

- Less than a third of those are actually for rent or for sale, meaning that many more could yet come onto the market.

- New contracts for previously owned homes fell at their fastest pace for two years.

- Some areas that have fallen fastest, like inland California, are seeing improved sales.

- Urban areas that have withstood the recession reasonably well, like San Francisco and New York, are “frozen.”

We pass Elk Grove on our way up to Tahoe. Beautiful spot east of Sacramento. You can buy a 3 BR house there for $193,000. The same house sold for $336,000 four years ago. The mortgage is a $100 less than it costs to rent a 2BR apartment. It’s hard not to think of that as positive. That is, unless you were the one who lost $143,000 in equity.

They’re predicting the housing market will get “worse” before it gets better. Why “worse”? Because a lot of people are going to feel — and be — a hell of a lot poorer than they used to. And the people for whom an increase in housing affordability might make a difference are the ones who are getting hammered the worst.

Here’s a chart showing future’s contracts on home prices. It shows prices deteriorating further this year, followed by a long, flat recovery starting some time in 2010.

Sounds like it’s going to be chilly spring.

Misha, an excellent read, thanks for keeping tabs on the trends for us, and for sharing your excellent analytical (not to mention charting) skills.

Any data or opinions on what’s happening in the rental markets? Trends in rents? Vacancy rates?

Thanks!

Thank you very much for turning me on to the NYT article that I missed this weekend.

Deeper downturn and chilly Sping, macroeconomically speaking. I know that you will find your hyperlocal sales activity – you are an excellent writer and analyst and you have nice looking site!

Good luck in the blog brawl!

Lee: Thank you thank you thank you!